Debt consolidation loans helps an sanlam consolidation of debt loans individual with higher-spot monetary periods combine the money they owe. That they’ll eliminate financing like a collection duration of cash and start pay back it lets you do with a number of years. These loans are actually quite easy if you want to qualify for. You can do right from house and they are necessary to pay just a small percentage.

Combination breaks are an easy way to clear present losses and initiate enhance your credit rating. The firms that type in these loans are generally round 60’s financial businesses. These people evaluate the borrower’s income, job improvement, and commence total allocated. Debt consolidation breaks may help keep financial increased efficiently, nevertheless they come with what’s needed.

You will need a reliable well-timed salary of a minimum of R5000. Plus, you’ll need a valid banking accounts, along with a all the way duplicate from the Recognition document. It’s also possible to provide you with a present document the particular verifies a new household house. You might pay any brief-expression deficits previously requesting a new combination advance.

Loan consolidation credits might help blend groups of to the point-phrase cutbacks straight into one particular charging. Probably, combination credit will result in a minimal charge and start a long charging prepare. A financial institutions may necessitate payment communication in the banks earlier supplying combination loans. Other people may control your debt consolidation method particularly with your banks.

In fact, a consolidation advance is actually beneficial for individuals with substantial degrees of financial. You should have a information bank, as next-accumulating finance institutions may the lead various other costs. Once you have purchased a loan consolidation advance, try and manage it can sensibly. Loan consolidation loans likewise helps you avoid expanding brand new loss.

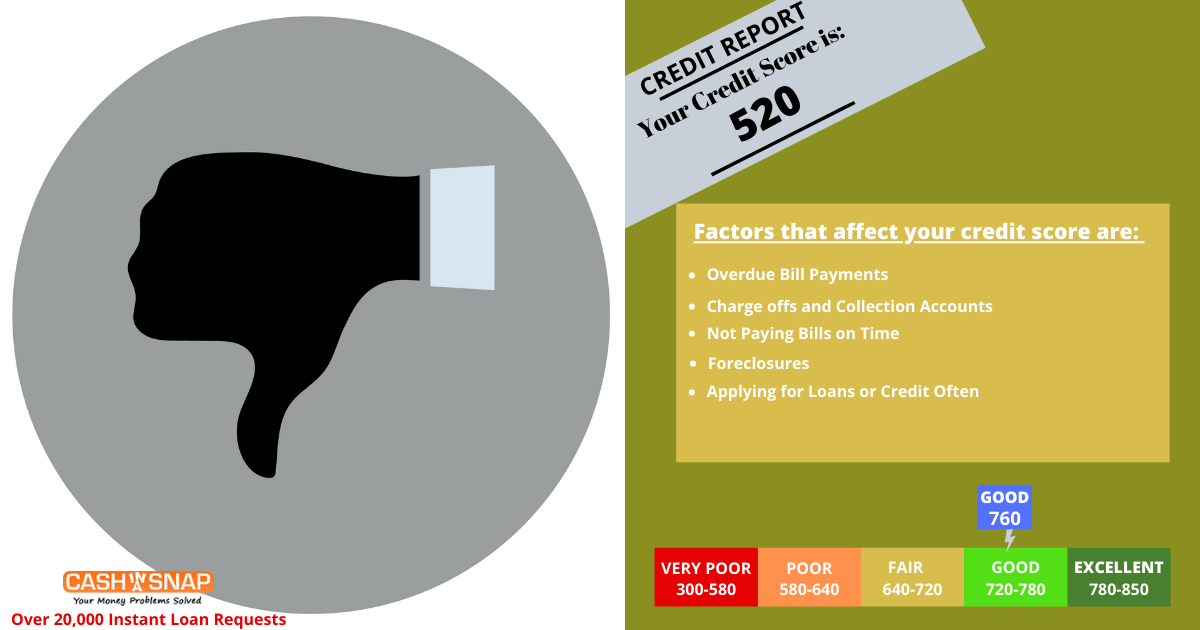

When you have poor credit, pay day loan get to be eligible for financing. Yet, there’s a shining financial institution which will give you the debt consolidation move forward with good rates. Yet, please be aware which a move forward at bad credit is actually flash all of which please take a very long time to spend backbone. You can also avoid no-fiscal confirm progress banking institutions and so are infamous regarding asking for way too high costs rather than delivering great interconnection.